Purchased: Dominion Homes Inc. (DHOM:NASDAQ)

Earlier this month, I talked a little bit about why and how I was looking for a US equity to buy. Now I’ll summarize the results of my search and say something about my plans for this stock.

Before we get into all of that, I have to say that writing this all down in public for anyone to read takes some nerve. I run the risk of my investing mistakes being exposed in plain view (I hate to be wrong about anything to do with money!) On the other hand, if this one turns out to be a tenbagger I can show off my stock-picking expertise. Tenbagger, or 10-bagger, is a term coined by Peter Lynch to refer to an investment that is worth ten times its original purchase price. To find out more about stalking tenbaggers, you could read One Up On Wall Street. I might even lend you my copy.

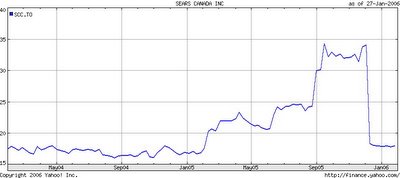

Before we get into all of that, I have to say that writing this all down in public for anyone to read takes some nerve. I run the risk of my investing mistakes being exposed in plain view (I hate to be wrong about anything to do with money!) On the other hand, if this one turns out to be a tenbagger I can show off my stock-picking expertise. Tenbagger, or 10-bagger, is a term coined by Peter Lynch to refer to an investment that is worth ten times its original purchase price. To find out more about stalking tenbaggers, you could read One Up On Wall Street. I might even lend you my copy.Of course, what usually happens with most of my investments is that (a) they make an OK return but are exceedingly boring (e.g., my mutual funds, banks, insurance companies, railroads); (b) they crash and burn and I just manage to sell before losing everything (e.g., Waverider, Enron, Bombardier); or (c) I hang on to them for years (e.g., Nokia, CAE, Sears) while they do nothing or just cycle up and down and then I sell getting my money back but not much more, right before some major event like an takeover bid by another company sends the stock into the stratosphere.

I spit nails when that happens!

Onwards...

A Short Review

Asset allocation, sources of investing ideas, blah, blah, blah, see here.

What I Purchased: Dominion Homes Inc.

Dominion Homes (DHOM:NASDAQ), formerly known as Borror Corporation, was formed in 1952 and is headquartered in Dublin, Ohio. They are a US-based homebuilder with operations in Ohio and Kentucky. They also have a financial services (mortgages) subsidiary. Recently, times have been tough for Dominion Homes with the softening of their market and high rates of mortgage defaults. As a result, their stock price has dropped to depths not seen since 2001.

Dominion Homes (DHOM:NASDAQ), formerly known as Borror Corporation, was formed in 1952 and is headquartered in Dublin, Ohio. They are a US-based homebuilder with operations in Ohio and Kentucky. They also have a financial services (mortgages) subsidiary. Recently, times have been tough for Dominion Homes with the softening of their market and high rates of mortgage defaults. As a result, their stock price has dropped to depths not seen since 2001.Why I Decided to Buy This Stock

I found this stock among Irwin Michael’s holdings. As I don’t directly own any US real estate or building and construction companies, I decided to take a closer look.

Shares are trading at just over $10 but book value is $23.61 per share. I always love a bargain! Irwin Michael says this company is a good candidate for privatization and also for acquisition by another builder. The company is profitable.

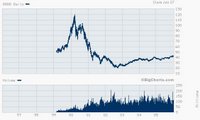

After a couple of disappointing buys that wiped out in the tech crash of 2000 (see the horrible chart over on the right), I made a note to myself to only buy companies that are actually making money. They have a new CFO. He’s been given the mandate to clean up the sales side and mortgage operations. A sudden CFO replacement is generally either a good sign or an extremely bad sign. I prefer to believe that, in this case, it’s a good sign. If they unexpectedly acquire a new CEO I’ll shift over to the It’s A Really Bad Omen side, especially since the CEO's last name is Borror and the Borror family owns almost half of the company.

After a couple of disappointing buys that wiped out in the tech crash of 2000 (see the horrible chart over on the right), I made a note to myself to only buy companies that are actually making money. They have a new CFO. He’s been given the mandate to clean up the sales side and mortgage operations. A sudden CFO replacement is generally either a good sign or an extremely bad sign. I prefer to believe that, in this case, it’s a good sign. If they unexpectedly acquire a new CEO I’ll shift over to the It’s A Really Bad Omen side, especially since the CEO's last name is Borror and the Borror family owns almost half of the company.My Exit Strategy (or, how I plan to make money on DHOM)

Ultimately, it’s not the buying, not the holding (unless you’re raking in dividends), and not the watching the price zigzag up and down from day to day where you make the money. It’s the selling. So, when to sell?

Here’s my plan.

Sell half when it doubles. I’ll get back what I invested and can go look for another winner to buy and the DHOM that I still own is all profit.

Sell the rest when it reaches $40 to $50 (my target price). OK, I know I said I wanted a tenbagger but I just don’t believe this stock has that much potential.

Sell when Irwin Michael sells it. After all, he’s the expert. And DHOM was originally his idea, not mine.

And what if a meteor falls out of the sky and squashes Mr. Borror on his way to work one day? I have a stop loss at $7.00. I’ll ratchet up the stop loss as the stock price rises to eventually lock in profits.

And what if a meteor falls out of the sky and squashes Mr. Borror on his way to work one day? I have a stop loss at $7.00. I’ll ratchet up the stop loss as the stock price rises to eventually lock in profits.I'll report back if something interesting happens. Watch this space.

And Now For Something Completely Different

Augustine Volcano in Alaska erupted again this weekend. Seismicity, pyroclastic flows and ash emissions have been observed today. Depending on the weather and whether or not it’s dark you might be able to see something interesting on the Augustine webcam. Here’s an image that was captured yesterday.

0 Comments:

Post a Comment

<< Home