Asset Allocation Revisited

No rat casualties the last two nights, I have to write about something else. Aren't you glad!

So, the topic today is Investing.

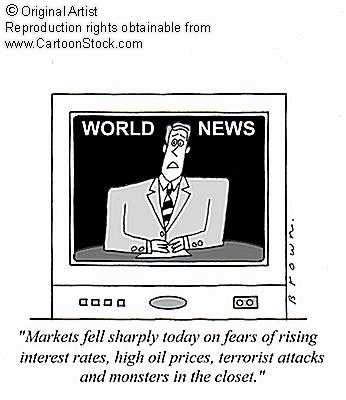

This latest run-up in the stock market is making me nervous.

It’s the wrong time of year for these types of advances, plus it’s throwing my asset allocation further out of whack.

It’s the wrong time of year for these types of advances, plus it’s throwing my asset allocation further out of whack.I’m a moderately aggressive investor who likes to buy-and-hold and can tolerate short term market downturns in return for higher long term gains. My target asset allocation model is 30% Canadian equities, 5% Canadian income trusts, 15% US equities, 25% international equities and 25% fixed income. However, my portfolio is actually more conservative than this model suggests since a large proportion of my equity investments, including the mutual funds, are in large profitable dividend-paying companies (e.g., banks and insurance companies) that are a lot less likely to crash and burn than your average small-cap technology or junior mining growth-oriented stock. (Been there, done that...)

I have become less and less of an actively managed mutual fund fan as the years go by so I look for opportunities to move money out of mutual funds and into ETFs and directly purchased stocks. Rejigging my asset allocation is one such opportunity.

Right now I am overweight in Canadian equities (big gains in resource/commodities sectors) and cash (I had a bond mature recently) and underweight in US equities (partially due to Cdn/US currency movements) and fixed income.

The cash from the matured bond is easy. I’ll just reinvest it in fixed income, probably an ETF such as the iUnits Canadian Short Bond Index (TSX:XSB).

As for the rest, I could realize some profits in my Canadian equities and shift the money into the USA. Blue Chips look attractive. They seem to have been out of favour for a few years so it might well be a good time to buy into big, solid, dividend-paying companies that market products all over the world. If we assume a significant market correction or economic softening will probably happen in the US this year then Consumer Products also look good. Even when times are bad, people continue to buy groceries, beer and cigarettes.

With this in mind I am considering the iShares Dow Jones Select Dividend Index ETF (NYSE:DVY) and companies like Wal-Mart (NYSE:WMT), Anheuser-Busch (NYSE:BUD) and Johnson & Johnson (NYSE:JNJ). I already own some Johnson & Johnson and adding to that holding wouldn’t bother me in the least.

But what should I sell?

At first glance, my Canadian National Railway (TSX:CNR) and Brookfield Asset Management (TSX:BAM.LV.A) holdings look like prime candidates. The CNR investment has almost tripled in value and several analysts have recently published opinions saying the stock is now fully valued and highly unlikely to advance further over the next year. In fact, it may be due for a significant correction. But the thing is that when I calculate my current dividend yield based on what I originally invested it’s getting close to 4% and I would hate to give that up. It’s such easy money!

At first glance, my Canadian National Railway (TSX:CNR) and Brookfield Asset Management (TSX:BAM.LV.A) holdings look like prime candidates. The CNR investment has almost tripled in value and several analysts have recently published opinions saying the stock is now fully valued and highly unlikely to advance further over the next year. In fact, it may be due for a significant correction. But the thing is that when I calculate my current dividend yield based on what I originally invested it’s getting close to 4% and I would hate to give that up. It’s such easy money! Similarly, BAM is yielding almost 5% for me and I’m even less willing to give that up.

Similarly, BAM is yielding almost 5% for me and I’m even less willing to give that up.I could sell CNR now and buy it back at a lower price when/if the correction happens. But that doesn’t support my objective of moving money from Canada to the US.

So I’m looking at my Canadian equity mutual funds. One of them surely needs trimming…

0 Comments:

Post a Comment

<< Home